In a positive sign for economic growth, a yardstick for business investment -- nondefense capital-goods orders excluding aircraft -- rose 2.1% in April, after climbing 4.6% in March and falling 2.4% in February. Economists viewed the reading as confirmation that business investment is on track to recover in the quarter and cushion an expected slowdown in consumer spending. The weakness in investment this year had caused concern among Federal Reserve officials. "We definitely seem to have turned the corner on business investment -- at least for now," said Ted Wieseman, an economist at Morgan Stanley in New York.

Morgan Stanley raised its forecast for business investment in equipment and software, saying it will grow at an inflation-adjusted annualized rate of 9% in the second quarter, up from the 8% growth it expected ahead of yesterday's figures. The new forecast compares with a 2% growth rate in the first quarter and a 4.8% decline in the fourth quarter of 2006. Yesterday's report also offered evidence that businesses are rebuilding inventories, after scaling them back earlier this year in response to sluggish demand. Manufacturers' inventories rose 0.5% in April after gaining 0.2% in March and 0.1% in February.

Shrinking inventories subtracted almost a full percentage point from the nation's annualized, inflation-adjusted economic growth in the first quarter, as businesses sought to clear their shelves of unsold goods.

The trend "strongly suggests that inventories are likely to rise further in the months ahead and contribute heavily to second-quarter and possibly third-quarter growth," wrote Abiel Reinhart, an economist at J.P. Morgan Chase & Co. in New York, in a research note. Friday, the Institute for Supply Management, a purchasing managers' trade group, reported that the picture for manufacturing continued to improve in May. The index of manufacturing activity rose to 55 last month from 54.7 in April. Any number above 50 indicates expansion.

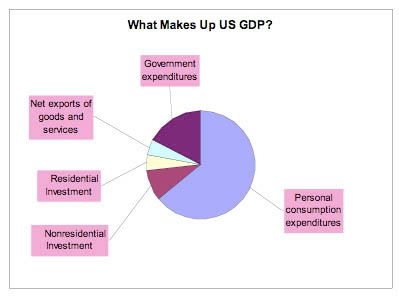

Here's a pie chart of the US economy. Business investment is the third largest area of the economy.

According to the Bureau of Economic Analysis, nonresidential investment grew at a seasonally adjusted annual rate of -3.1% in the 4th quarter of 2006 and 2% in the first quarter of 2007. These figures were cause for concern because they indicated business was shying away from investment. While that alone would probably not be enough to send the economy into recession, that combined with a housing slowdown was.

However, there have been several stories over the last few weeks regarding a positive outlook for business investment. While the figures are not conclusive, they do indicate business may finally be increasing its pace of investment.