Tom Sowanick, chief investment officer for investment manager Clearbrook Financial LLC's Clearbrook Research unit, says concerns that rising rates will hurt corporate stocks may be overblown. He notes that since its June 2003 trough, the yield on the 10-year Treasury note has climbed two percentage points, and the yield on the two-year note has risen nearly four percentage points. During the same period, he says, the S&P 500 has risen 64%, while the Russell 2000 Index, a measure of small-stock performance, is up 95%.

Let's look at a few points.

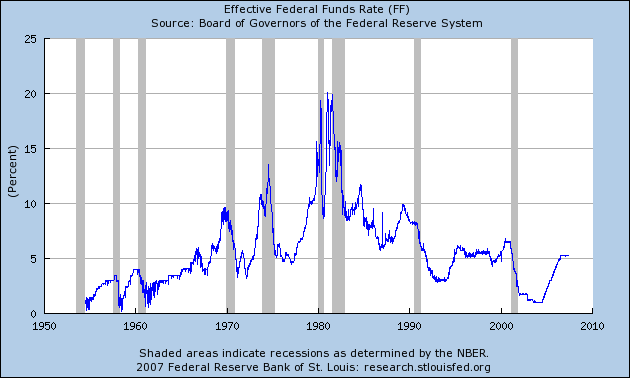

1.) US interest rates are rising from generational lows. Here is a chart of the effective Federal Funds rate. Notice it is rising from the lowest levels of a generation.

So -- while interest rates are increasing, it's important to remember where they're rising from: the lowest rates we'll see in our lifetime.

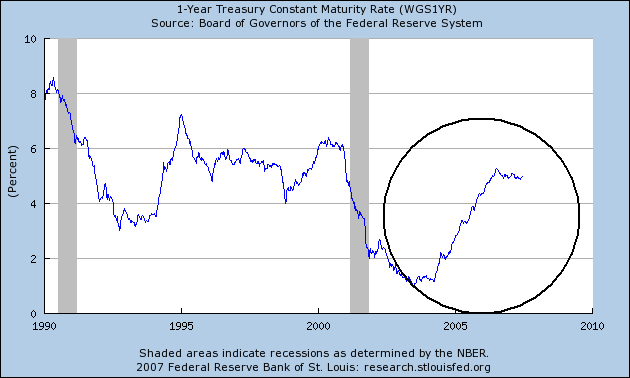

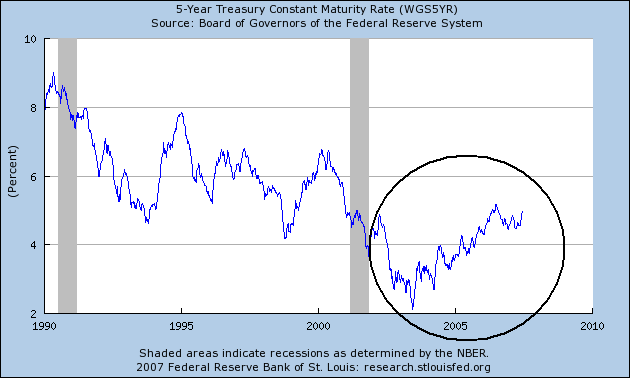

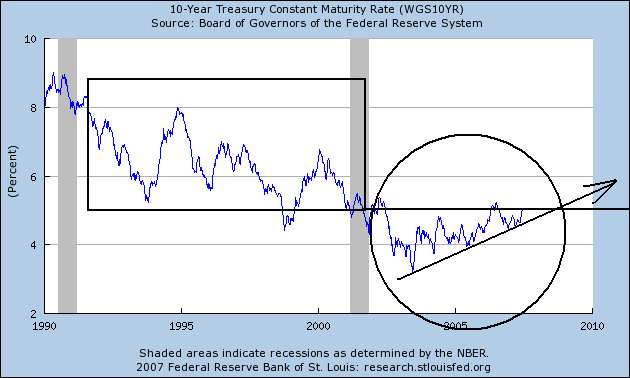

2.) The 1, 5 and 10 year constantly maturing Treasury Bonds have all been rising for the last few years with no impact on corporate profits.

1-Year Treasury

5-Year Treasury

10-Year Treasury

I've added a few more points to the 10-year chart. First, notice current yields are just now approaching and broaching the lowest levels of the preceding expansion's interest rate levels. In the 1990s expansion corporate profits grew just fine. So some of the concern may be overblown.

In addition, most companies have very strong balance sheets and have already locked-in lower borrowing costs:

There are several reasons the initial shock over higher Treasury yields has quickly worn off. For starters, most corporate debt is locked in for the long term, and won't roll over for years -- as long as a decade for some companies with investment-grade bonds outstanding.

At the same time, many companies are so flush with cash after several years of booming profits that increased borrowing costs won't make a big difference at this point. Excluding financial companies, components of the broad Standard & Poor's 500-stock index have enough cash on hand to buy back 40% of their outstanding long-term debt, S&P says.

However, notice that 10-year rates are clearly increasing and will probably maintain that course for the foreseeable future. In other words, the rising rate story will probably be with us for the remainder of this expansion.

Most of the interest rate stories over the last few weeks have an implied premise: there is an inflection point in interest rate levels above which rising rates have an increasingly negative impact on corporate growth. I think this is more of a sliding scale, where an increasing level of rates by x% will lower corporate profits by y% or something to that effect. In addition, I don't think current interest rate levels are so high as to inhibit profit growth. The main factor causing slower profit growth is a slowing US economy, not higher interest rates.