One of the theories that made the most sense to me was the Dow Theory, which according to Wikipedia:

In Dow's time, the US was a growing industrial power. The US had population centers but factories were scattered throughout the country. Factories had to ship their goods to market, usually by rail. Dow's first stock averages were an index of industrial (manufacturing) companies and rail companies. To Dow, a bull market in industrials could not occur unless the railway average rallied as well, usually first. According to this logic, if manufacturers' profits are rising, it follows that they are producing more. If they produce more, then they have to ship more goods to consumers. Hence, if an investor is looking for signs of health in manufacturers, he or she should look at the performance of the companies that ship the output of them to market, the railroads. The two averages should be moving in the same direction. When the performance of the averages diverge, it is a warning that change is in the air.

Sometime over the last few months, a commenter posted a really good observation. With the US becoming more technologically innovative wouldn't another average be a better confirming indicator? He suggested something along the lines of a communications average as a confirming indicator. Intuitively this also makes sense. US business is communications dependent. As business becomes busier, they will utilize more communications.

However, I still believe the transport average is incredibly important. First, the US still produces a lot of "stuff". Secondly, the US consumer is now responsible for 70% of US GDP growth and a lot of the consumer's purchases are made overseas. These consumer goods have to be transported from overseas to U.S. ports. The goods then have to be shipped from the ports to consumer markets. As a result, transport activity is still a very relevant metric of economic measurement.

That's why stories like this get my attention:

Cargo containers crammed with foreign-made goods that were supposed to set a record in August at major U.S. ports took an unexpected turn, with imports sinking 1.4% in another sign of the slowing of the economy.

Imports of items as diverse as toys and tiles could also be lower in September and October, when retailers will be stocking shelves for the holidays, because shell-shocked shoppers are expected to continue to pull back.

The falloff "reflects the consumer-demand-driven weakness in the U.S. economy," said Paul Bingham, an economist with Global Insight, a research firm that monitors cargo movements for the nation's top retailers.

The slump in oceangoing imports unloaded at the 10 largest U.S. container ports in August was the first drop since Global Insight began its monthly Port Tracker report in 2005. The number stunned some port watchers.

Granted, it's the first drop. But there is other news emerging from the transportation sector that indicates all is not well.

From Railfax here is the year over year percent change in total railroad traffic:

Transports importance to the economy as a whole was a central reason why Ryder's recent announcement was important:

Trucking and logistics company Ryder set off economic alarm bells Monday morning when it issued an earnings warning that it attributed to the economic slowdown spreading beyond housing and construction.

The meltdown in the mortgage and credit markets this summer, and the corresponding hit to the U.S. housing and home building markets, have been well documented by economists and investors. Many have also been anticipated that the problem may spread beyond those sectors.

Ryder, which manages and operates a fleet of more than 140,000 vehicles ranging from tractor-trailers to light-duty trucks for a wide variety of companies' transport needs, said that it is seeing a slowdown in business activity from its clients.

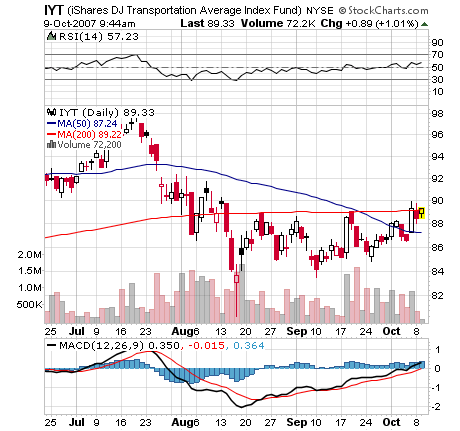

The bottom line is the transportation sector is sending warning signals right now. And the transportation average still isn't confirming the recent rally, which is cause for concern.