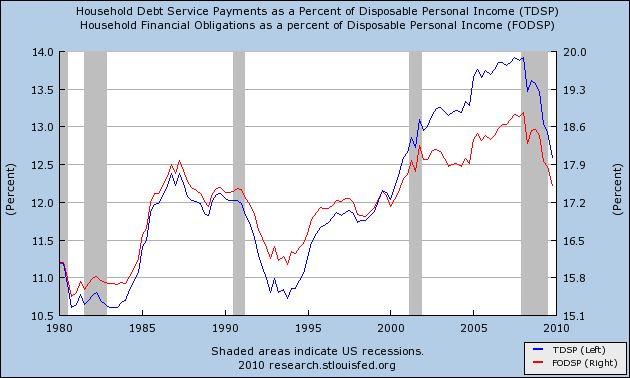

Two of the most important statistics concerning the health of the household balance sheet were released with little fanfare last Friday. They don't lead, and they are reported for the last quarter (in this case, the 4th quarter of 2009), so there is unfortunately a considerable lag, but they are nevertheless quite valuable. These are the ratios of household debt service (blue) and total financial obligations (red) to disposable personal income:

Both continued their steep decline at the end of 2009. Debt service, at 12.60% of disposable income, and total financial obligations, at 17.51%, are at the lowest level since the second half of 2000.

If the trend continues, then by the end of this year, household obligations will be well into the midrange for the 1980s and 1990s. In other words, households will be in much better shape to purchase goods and services than they have been in a long time. This bodes well for the economy going forward in 2011 and beyond.