I've been writing about this topic for well over a year, and here we are again.

Reading the punditry is an excellent exercise in watching cognitive psychology at work. If you are a gold-bug like Mish, then the slowdown is about money printing. The Fed must be abolished and the gold standard re-adopted. If you are the Calafia Beach Pundit (Scott Grannis), then the slowdown is about the failure of Keynesian stimulus. To the contrary, if you are Paul Krugman, then the slowdown is about the inadequacy of the stimulus. And if you are Robert Reich, it is about failure to put spending power in the hands of ordinary Americans.

In short, the slowdown is like a Rohrshach blot onto which pre-existing worldviews are projected.

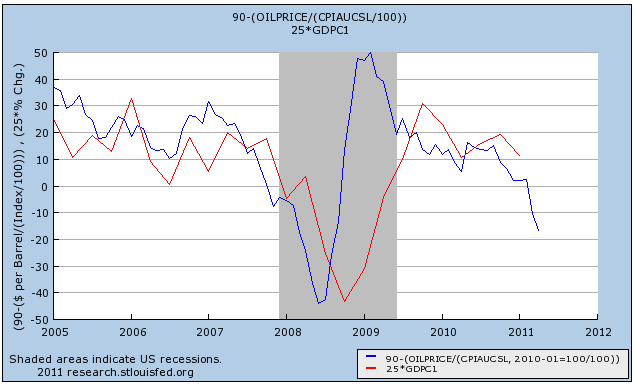

It ought to be clear that my political sympathies are with Krugman and Reich, but I'm not sure we need a particularly sophisticated explanation for the slowdown. Making use of Occam's razor, we can simply say that it is all about Oil prices. Here is a graph for the last 6 years of inflation-adjusted Oil prices where January 2010 prices = 1, where Oil analyst Steve Kopits' metric of Oil at 4% of GDP = $90 (blue). Real GDP growth is in red (*25 to make use of the same scale):

Over that time period, simply knowing the "real" price of Oil has been an excellent forecasting tool for GDP in the same or next quarter. (You may recall that Prof. James Hamilton found that his energy price shock model explained about half of the decline in the great recession).

As to other suggested contributing factors, Japan has just shifted demand back a quarter or two. If production slows now due to an availability of parts, it will make up the difference once the parts supply returns to normal.

As to Europe, if it were a real problem, we would see financial fear spiking again. To the contrary, as I pointed out last week, both the TED spread and LIBOR are comatose.

So the stop-and-go recovery comes back to a lack of a sustainable strong increase in consumer demand. Part of that is housing still being flat on its back, part of it is stagnating if not declining household wealth and near-deflation in wages. And how much consumers do have to spend in the productive economy depends very much on the wildly fluctuating price of Oil, which in turn is serving as a choke collar, cutting off the oxygen flow every time the recovery starts to run.