The only reason to qualify the typical leading/coincident/lagging indicator paradigm, in my opinion, is significant immediate government action. A decline in important foreign trading partner economies will show up in manufacturing data here first, as well as stock prices (as future earnings of companies with exposure are downgraded). An outright decline in those economies should also show up as decreased cash to invest in our bonds, and hence bond yields should rise. In other words, the importation of foreign weakness should show in leading indicators first.

But imagine for example an immediate 50% tax increase on everything enacted by the government. Virtually every economic indicator would decline in unison. No leading/coincident/lagging steps there.

The question is, was the confidence shattering debt ceiling debacle in Washington -- in which House Republicans even at the end could not muster a majority to vote in favor of paying our bills, even after Barack Obama offered up the crown jewels of the 20th century, Social Security and Medicare, as an enticement -- such an event? Only 174 House Republicans voted for the debt deal. They had to be rescued by Nancy Pelosi's democrats, otherwise the deal would not have passed and the US would have defaulted on its debts.

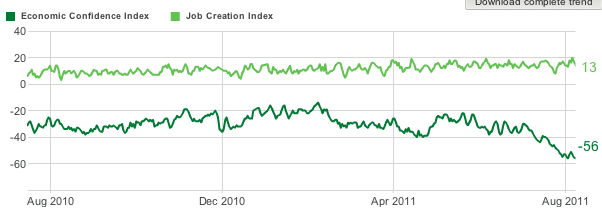

Gallup's daily consumer confidence poll plummeted between July 5 and August 3:

The Euro crisis was in the headlines before, and intensified after that period, without any effect on the poll results. The S&P debt downgrade didn't happen until August 4, so is also not responsible. So what happened specifically in that period?

Over the 4th of July weekend Barack Obama explicitly offered up Social Security and Medicare for sacrifice in a "grand bargain," and the sausage making over how to gut the fundamental social contract continued until the debt ceiling deal, which did not include cuts - for now - was passed on August 2. As mentioned above, even at the end the deal did not have enough GOP support to pass the House. The result was, as Gallup reported, that Upper Income Americans' Economic Confidence [was] Shaken. The economic confidence of Americans with disposable income plummeted abruptly beginning during this period, to a bottom not seen since the depths of the recession. And when the affulent (roguhly the top 25%) cut back spending, the economy suffers immediately. The report is short but hard hitting, and I highly recommend you click throough and read it in its entirety.

Since that time, we have seen July and August real retail sales turn negative, and same store sales for at least one service - Shopertrak - were totally flat YoY in the first full week of September.

Bonddad and I had a number of conversations during and after that period, and both of us felt that something profoundly unnerving had occurred. Washington was truly under the thumb of lunatics, and the crown jewels had been offered up for potential evisceration. Is that itself sufficient to disrupt the normal progression of the economic cycle? Apparently we will find out together.

More tomorrow.