Friday, December 23, 2011

Morning Market

After gapping higher and then rallying, the dollar moved downward in a channel before gapping lower three days ago. However, prices have been moving sideways for the last three days and are still above the lows set from the upward gap.

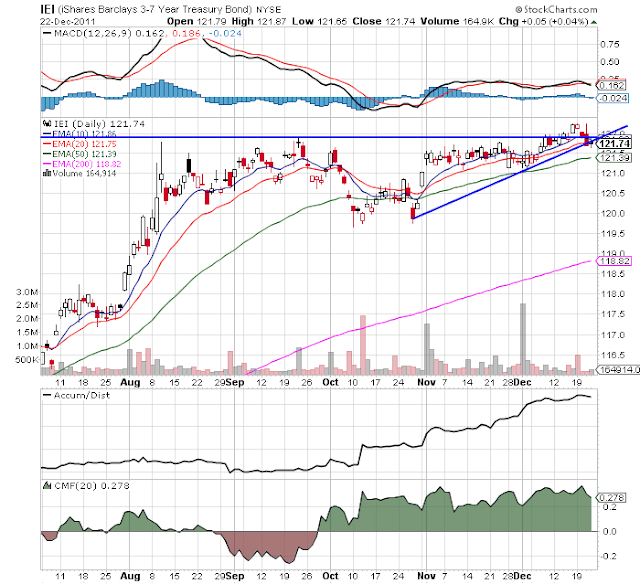

The IEIs are right at technical support. While the chart is still bullish technically (EMA, A/D, CMF and MACD), prices advanced through technical resistance a few weeks ago but couldn't hold onto the rally. This chart bears watching as it could be the first treasury sector to move below important resistance.

After falling earlier this year, copper have been consolidating for the last three months in a symmetrical triangle. However, note the A/D line is still at levels seen earlier this year, and the CMF indicates we haven't seen a massive exodus from the market. Also note the MACD is very close to giving a buy signal.

The Australian dollar -- which has been consolidating in a symmetrical triangle -- is close to a break-out.

Finally, the IWM (the Russell 2000) is still consolidating. Notice that as prices have approached the upside resistance line the candle bodies have gotten smaller.