Over the last week I've been re-examining and updating my January forecast. While I believed there would be weakness in the first half of the year, I considered it unlikely that it would bring about an actual recession. This puts my view at odds with ECRI's (although it is right on point with the contrary viewpoint of the Conference Board, publishers of the official LEI's).

So why am I not persuaded by ECRI's latest arguments? A number of reasons. First of all, believing that the seasonal adjustments after the 2008 recession may be suspect isn't grounds for disregarding them and instead adopting a view based on more lagging year-over-year metrics. That simply means that the seasonal numbers MIGHT be wrong, not that they ARE wrong. So if the monthly and the YoY trends disagree, it only means that we can't be sure which is right, NOT that the YoY trend is correct.

Secondly, coincident indicators are coincident, period. They should not be interpreted as leading.

Finally, I believe that ECRI has changed the make-up over several of its indexes in the last 20 years. This reflects a subjective, editorial judgment. Where the two versions of the index diverge, extra caution is warranted. In fact, I believe ECRI is being misled by several series upon which it relies heavily, which either no longer mean what they used to for the US economy, or are having unique problems (more on which, tomorrow).

In his 1990 book, Prof. Moore listed the Federal Reserve Bank's H8 weekly release as one of the elements of the Weekly Leading Index, and it was included in the WLI as least as late as 1993 when it was publised in Business Week magazine. But by 2002 that had changed, with Achuthan telling CNN Money that

The WLI contains seven major economic indicators, including mortgage applications for purchase, money supply, sensitive industrial prices, bond yields, bond-quality spreads, stock prices and weekly jobless claims.Does the substitution of the MBA's purchase mortgage index for the FRB's weekly H8 release make a difference? Absolutely.

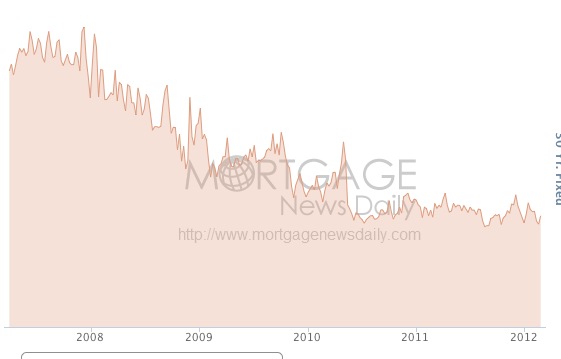

Here's the PMA, currently used in the WLI. It's been flat for almost the last 2 years and has actually dipped into negative territory on a YoY basis for the last few months:

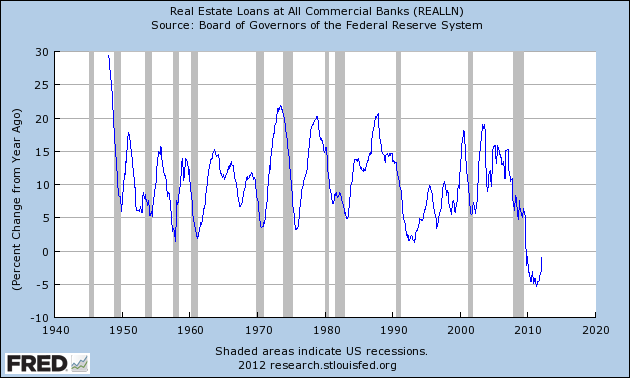

Now here is the YoY growth rate of the FRB's H8 release. It continued to decline at a decreasing rate until it turned up sharply three months ago:

This shows the H9's recent history in more detail, through February. It is now at 0 on a YoY basis.

If the FRB H8 release were still part of the WLI, there would have been a sharper decline in 2009, and the period of flatness would have ended a year ago, with an increasingly stronger move upward since.

An even more important change is the Conference Board's explicit dropping of Real M2 as a component of its index. Just as importantly, although Real M2 is included in both Professor Moore's 1992 list of the WLI, confirmed by its inclusion in the Business Week index in 1993, and reconfirmed by Achuthan in 2002, it now appears that ECRI has also either trivialized or completely dropped Real M2 as a component of its WLI in favor of credit spreads.

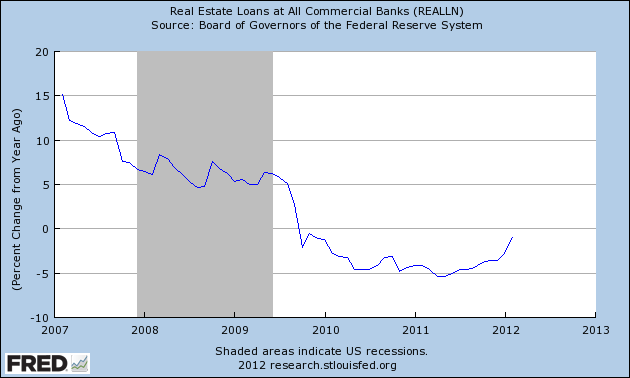

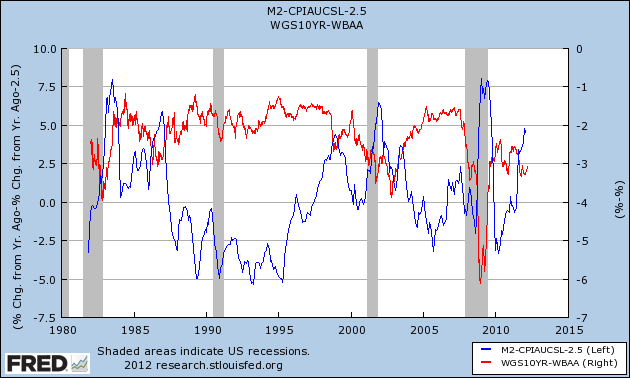

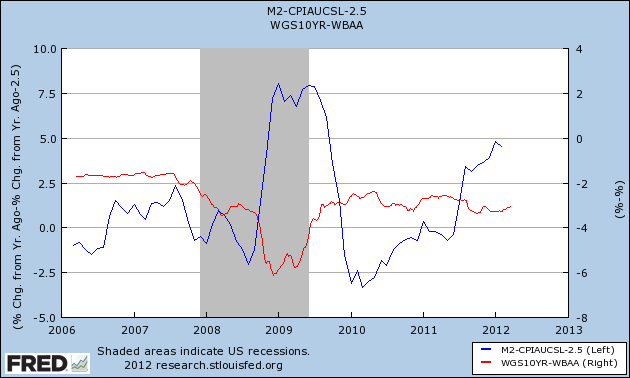

To show just how big a difference that makes, here is Real M2 YoY in blue, and credit spreads in red:

Here is a close-up of their wildly differing trajectories in last August and September:

Both of these were essentially caused by the same thing: Europeans fleeing European banks and making deposits in US banks and purchasing US treasuries. M1 and M2 skyrocketed, while credit spreads blew out.

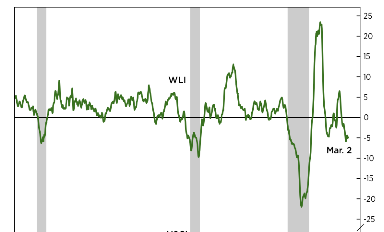

Despite that, ECRI's WLI shows that it caught all of the negative blowing out of credit spreads, but apparently none of the moonshot in M1 and M2:

Indeed, if real M2 were still part of ECRI's WLI, it is hard to see how it could have gone negative at all. Add the difference in H8 to that, and it is very unlikely that ECRI would have made a recession call last year.

Beyond that, while the Conference Board deleted Real M2, it was at least transparent, and also the changes in the LEI did not change the ultimate direction of that set of indicators. In the case of the WLI, if I am correct, the decision DID change the direction of the indicators. Further, this decision was inherently subjective, a matter of human judgment.

So ECRI's recession call is not compelled by objective data. Rather, it is a function of a subjective *choice* as to which objective data were left in the index and which were not. When such a choice leads to conflicting outcomes, extra caution is warranted.