- by New Deal democrat

- by New Deal democratMedian wage growth:

This is the increase that 50% of workers are getting more than, and 50% are getting less than, on a year-over-year basis. It has been running at under 2% at all times since the financial collapse of 2008.

So, even if inflation runs at the very modest rate of only 2% (and for most of the time since the bottom of the recession in 2009, it has been higher than that), more than half of all workers fail to keep up.

You simply cannot have a durable economic expansion where most workers are consistently falling behind.

There are a few other graphs that give me hope, but only on a temporary basis.

Mortgage refinancing:

Lower mortgage rates in the last several years has enabled a huge number of consumers to refinance. Therefore...

Household debt ratios:

the average household has a lower carrying cost of debt, compared with their income, than at any point in the last 30 years [note that this series ends in December 2011, and won't be updated again until June sometime].

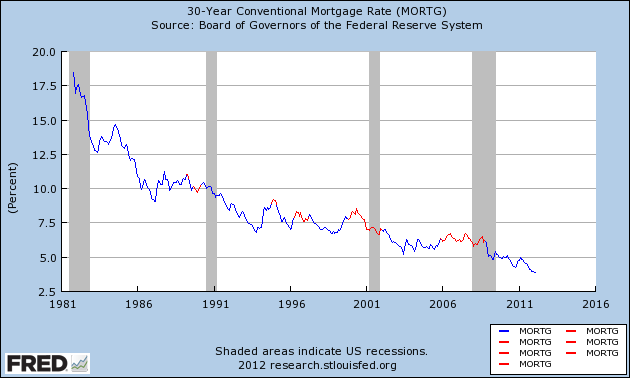

In the past 30 years,as shown in this graph of mortgage rates, which highlights those periods where interest rates are higher than they were 3 years prior in red, once households have been able to refinance, it took at least 3 years without new lows being established, before the economy fell back into recession.

We just set new lows.

It's difficult to imagine any further round of refinancing once this one is done. Can rates really go much lower?

If median wage growth doesn't improve soon, there will be no escaping another recession once the effect of refinancing has run its course, and in the meantime, it's hard to imagine broad-based economic growth.

This time around, we managed to escape without actual wage deflation (although laid off workers may not have been able to find work at the same salary they were making previously). I doubt we will be so lucky a second time, and we may not have even regenerated all the jobs lost in the last recession before the next one hits. I doubt that happens this quarter, or this year, but the more time goes on, the bigger the risk becomes.