- by New Deal democrat

I agree with Bonddad that yesterday's housing starts and permits report the best economic news in a long time. Why? Because housing always leads the economy, and the direction of that lead lasts a year or two into the future. And at this point, the positive trend in housing construction is strongly established.

The most important measure of housing construction isn't how much of a recovery there has been relative to the last peak, but how many additional houses are being built now compared with the last measurement period. For example, going from 0 to 200,000 new houses in a year adds just as much new employment as going from 2,000,000 to 2,200,000 new houses. The same amount of new construction workers are needed to build those 200,000 additional houses, the same amount of appliances and furniture will be bought to fill them, etc.

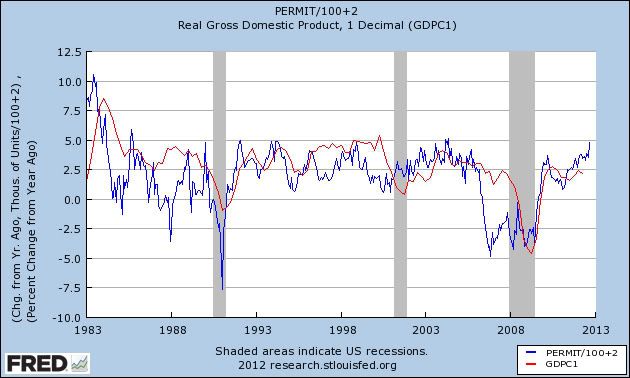

This isn't idle bloviation, it's backed up by the data. Here are three graphs to drive the point home. First, here is a graph of the YoY change in the number of houses built (blue) vs. the YoY percentage change in GDP since 1983 (red):

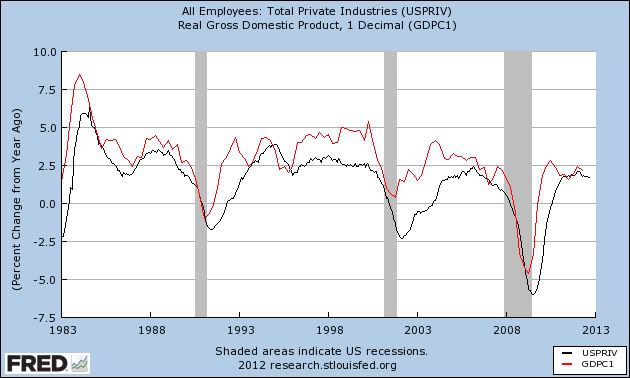

For every 200,000 additional houses built, GDP consistently increases over trend by 1%, with a variable lead time of several quarters to several years. But of course GDP growth is an imperfect measure of workers' economic well-being. What the next graph shows is that GDP growth (red) consistently leads job growth (black):

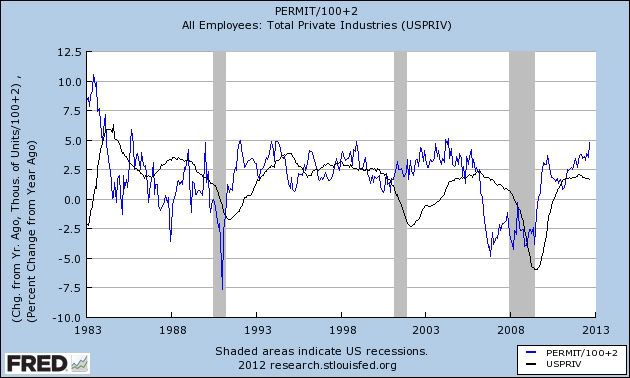

Since housing construction increases consistently lead to GDP growth, and G D P growth consistently leads to job growth, it should be no surprise that that housing construction (blue) increases consistently lead to jobs growth (black):

Yesterday's data gives us the best YoY housing construction growth in 8 years, and equal to the best growth in over 25 years! This rate of growth in the last 30 years has been consistent with subsequent 4% or even 5% YoY GDP growth, and further consistent with 2% or 3% jobs growth YoY within the next year or two.

In other words, the best economic news in a long time.

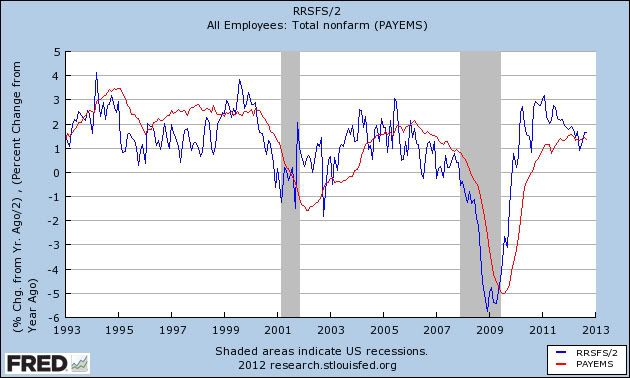

While I'm at at, the second best Econ news has to be the increased consumer spending in the last couple of months. Real retail sales are the "holy grail" leading indicator for jobs over the next 6 months or so. Measured YoY and then divide by 2, and you usually get a pretty good idea of YoY job growth in the near future. The YoY trend in growth had been declining but has now rebounded. Here's the graph:

In other words, both the long leading indicator of housing and the short leading indicator of consumer spending are point to an improving jobs picture in the near future.